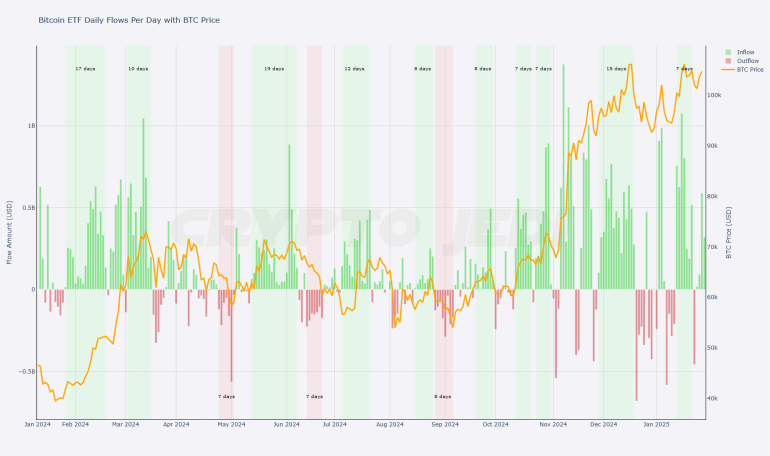

Since the launch of Bitcoin ETFs, we have observed clear patterns in the dynamics of capital inflows and outflows. These movements not only reflect institutional interest but also directly influence BTC price action.

Key Trends in ETF Flows

Prolonged streaks of capital inflows: Up to 19 consecutive days of purchases have been recorded, indicating strong demand and systematic acquisition behavior by institutions.

Short outflow periods and their impact on price: When selling periods remain short (three days or less), Bitcoin tends to gain positive momentum.

The downward pressure of extended outflows: If selling periods extend, the price tends to be negatively affected. However, so far, the longest outflow streaks have lasted only 8 days, while inflows have lasted up to 19 days. This suggests that institutional investors are taking advantage of dips to buy more BTC rather than signaling a trend reversal.

This behavior reinforces a key point: prolonged buying streaks tend to be associated with better price performance.

What’s Happening Now?

In December and early January, the market was dominated by capital outflows. However, last week marked a significant shift: seven consecutive days of inflows, interrupted by just one day of selling.

This suggests the beginning of a new bullish phase, although without a guarantee of continuation. While purchases have recently prevailed, their persistence over time will depend on various factors, including the market's response to future Federal Reserve decisions and institutional investor sentiment.