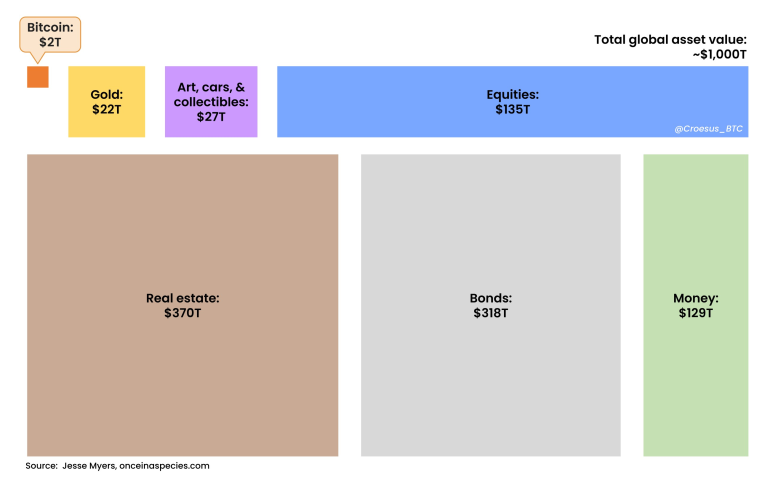

For decades, real estate has been the primary safe haven for those seeking to preserve wealth. With a global valuation close to USD 400 trillion, it surpasses any other financial asset by far. But that supremacy is starting to crumble. A new player is changing the rules of the game: Bitcoin.

In a recent analysis, Bitcoin Magazine contributor Martin Matejka puts forward a bold thesis. Bitcoin isn’t just competing with gold or stocks. It's beginning to absorb part of the monetary premium that inflated real estate prices. Why? Because of its superiority as collateral, a generational shift, and a growing demand for portable and neutral digital assets.

The Real Estate Bubble and Its Monetary Premium

Much of the rise in housing prices is not due to their utility as living spaces but to their role as a store of value backed by credit. Banks love real estate. It's tangible, easy to appraise, hard to move, and protected by property laws. That’s why almost anyone can get a mortgage. This steady liquidity fuels demand, even if net rental yields barely reach 3%.

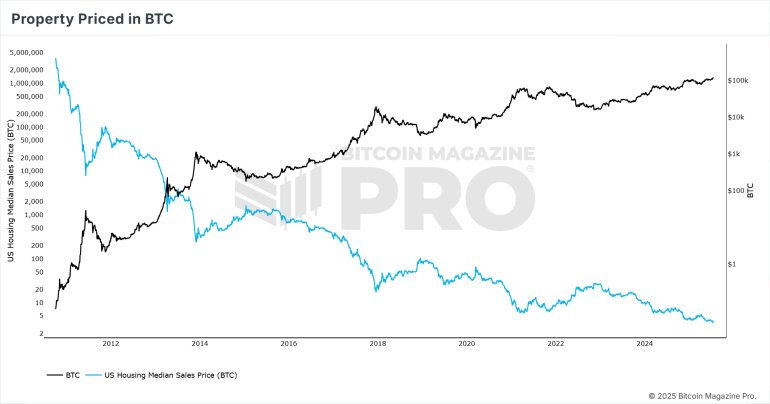

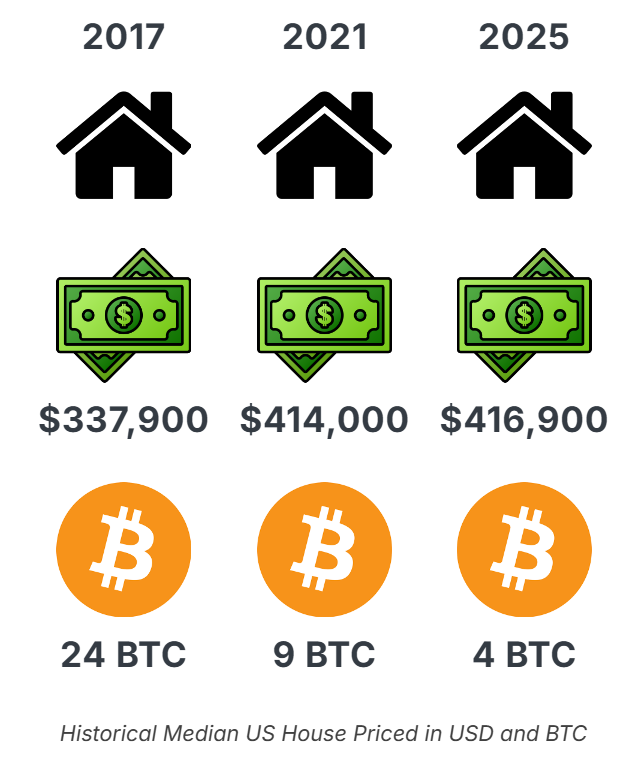

But when property values are measured not in dollars but in Bitcoin, the story changes drastically. The following chart shows how the median home price in the U.S. has steadily lost value against BTC over the past decade.

In 2017, an average house cost 24 BTC. Today, it costs just 4 BTC. Purchasing power in Bitcoin terms has kept growing, while real estate loses ground as a store of value.

Generational Shift, Young Capital Has Already Chosen

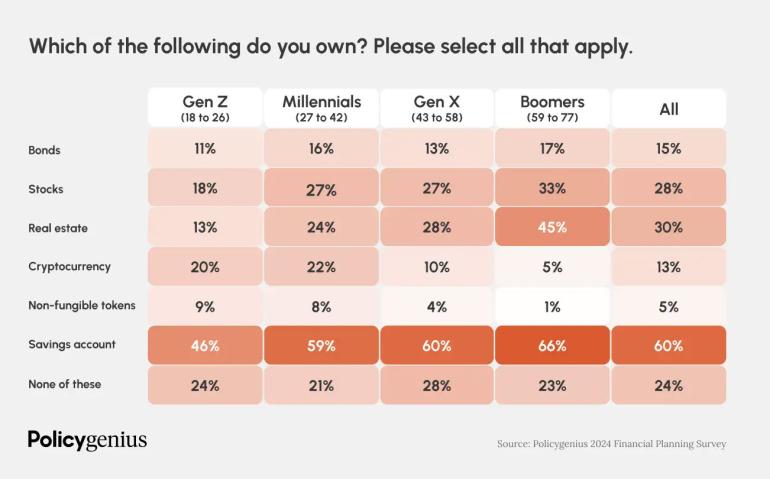

Younger generations not only face unaffordable housing prices, they’re actively choosing alternative ways to store value. According to the 2024 Policygenius survey, Zoomers have more exposure to crypto (20%) than to stocks (18%) or real estate (13%). Among Millennials, the trend is similar: 22% in crypto versus 24% in property.

This is no whim. The preference for Bitcoin reflects a need: global liquidity, portability, censorship resistance, and financial sovereignty. You can’t put a house in your pocket. But you can carry Bitcoin.

Bitcoin as Superior Collateral

The key lies in collateral function. Bitcoin is instantly transferable, divisible, verifiable, and doesn’t require a legal system to enforce ownership. In a world of programmable collateral, Bitcoin holds every advantage over bricks and mortar.

As the market for BTC-backed loans expands, millions will be able to access liquidity without selling. This already happens on DeFi platforms, but institutional adoption will accelerate the trend. If borrowing against BTC becomes easier, cheaper, and safer than against a house, capital will shift quickly.

A Global Revaluation Underway

The data reveals a clear trend. Bitcoin is taking over part of the monetary function real estate used to monopolize. If it captures even a fraction of the monetary premium embedded in the real estate market—estimated in the tens of trillions—a global revaluation event will unfold. One that many still underestimate.

Bitcoin today represents only a tiny fraction of total global assets. But as Jeff Booth once said, "The future moves from the old system to the new one, not the other way around."

And in that future, the store of value doesn’t come with foundations or deeds. It comes with private keys.