Despite its growth, some investors still see Bitcoin as a "marginal asset," equating it with speculative investments like collectible cards or digital art. However, the data tells a very different story.

Bitcoin's market size

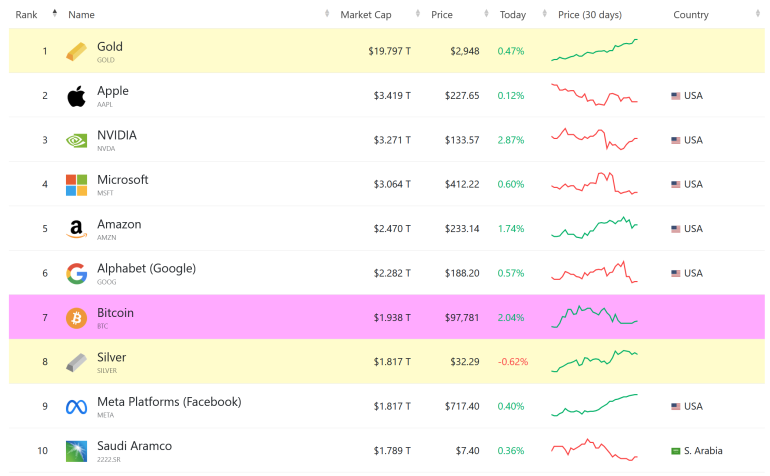

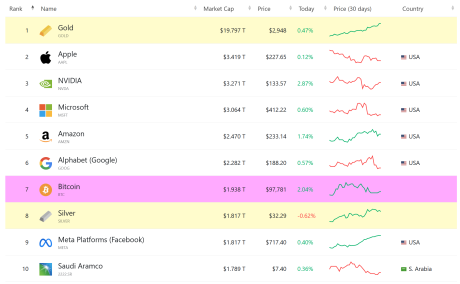

With a market capitalization of $2 trillion, Bitcoin ranks among the largest financial entities in the world, on par with major global corporations. This places it above giants like Visa and close to the value of companies like Amazon and Microsoft.

Additionally, Bitcoin has proven to be a highly liquid asset with growing adoption, attracting both retail and institutional investors.

The impact of Bitcoin ETFs

One of the biggest recent changes in Bitcoin’s perception has been the rise of spot Bitcoin ETFs. Within just a year of their launch, these products have achieved:

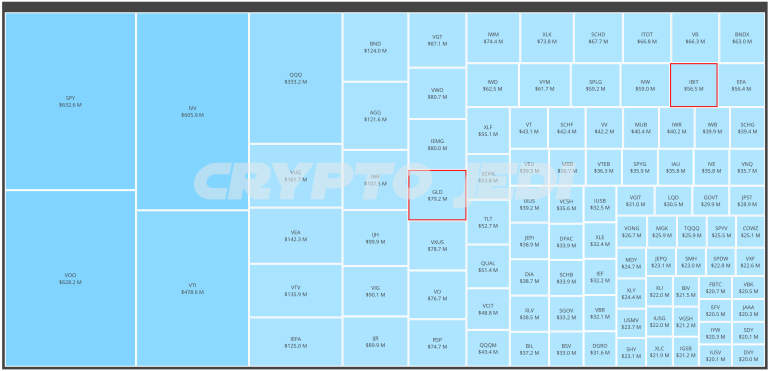

- $41 billion in net inflows, making them one of the most successful ETF launches in history.

- Three Bitcoin ETFs among the top 100 by assets under management.

- The BlackRock ETF (IBIT) now manages nearly $60 billion, approaching the gold ETF GLD, which currently holds $79 billion. Unlike gold, which took 20 years to reach that scale, Bitcoin achieved it in just one year.

These ETFs have enabled greater institutional participation, providing access to Bitcoin for pension funds, insurers, and other major financial market players.

Bitcoin and its integration into the financial system

The growth of ETFs and the increasing involvement of major institutions show that Bitcoin has surpassed the speculative phase and has become a key asset within the global financial system.

Furthermore, Bitcoin’s size and institutional adoption have significantly reduced regulatory risks. Unlike previous years, when its legal status was uncertain, today it has regulatory approvals in key markets such as the United States, Europe, and Asia.

No reason to keep waiting

Bitcoin has demonstrated its ability to grow and gain institutional adoption. For those who have not yet invested, there are fewer and fewer reasons to delay their entry into this market. The integration of Bitcoin into the traditional financial system indicates that its role will only continue to strengthen over time.