The U.S. fiscal deficit has been a recurring problem, but recent data shows that the situation is even worse than expected. While the widely cited figure is an annual deficit of $2 trillion, current numbers indicate that the actual annualized deficit is $2.5 trillion.

A Rapidly Growing Deficit

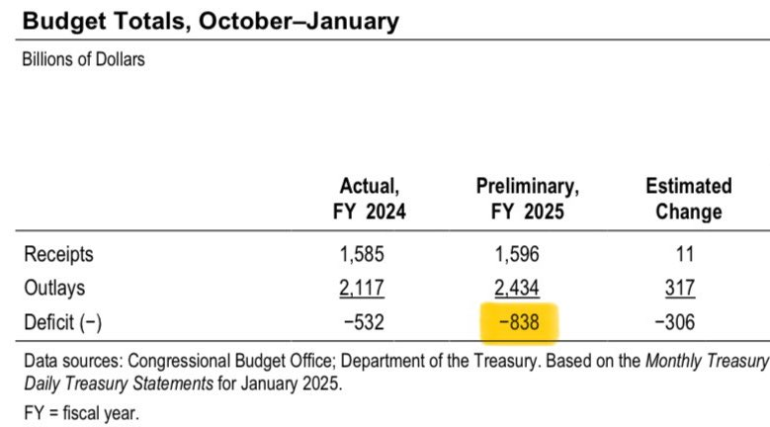

According to Geiger Capital, in the first four months of fiscal year 2025, the deficit reached $838 billion, representing an increase of $306 billion compared to the same period last year. This means that the deficit is growing at a 25% year-over-year rate, a completely unsustainable trajectory.

To grasp the severity of this growth, consider that every 100 days, $1 trillion is added to the national debt—a figure that will be difficult to sustain without serious economic consequences.

Attempts to Reduce Spending

The Department of Government Efficiency (DOGE) has managed to cut some government expenses in recent weeks, achieving a reduction of approximately $1 billion in 24 hours. Some of the most significant cancellations include:

- 18 contracts in the Department of Agriculture, worth $9 million.

- 29 DEI training grants in the Department of Education, totaling $101 million.

- 89 additional contracts in the Department of Education, amounting to $881 million.

While these efforts are a positive start, even larger cuts are needed to achieve a balanced budget.

Bitcoin as a Hedge Against Debt

The growing deficit and national debt have a direct consequence: inflation harms those holding cash in U.S. dollars. In response, investors seek refuge in assets that protect their wealth.

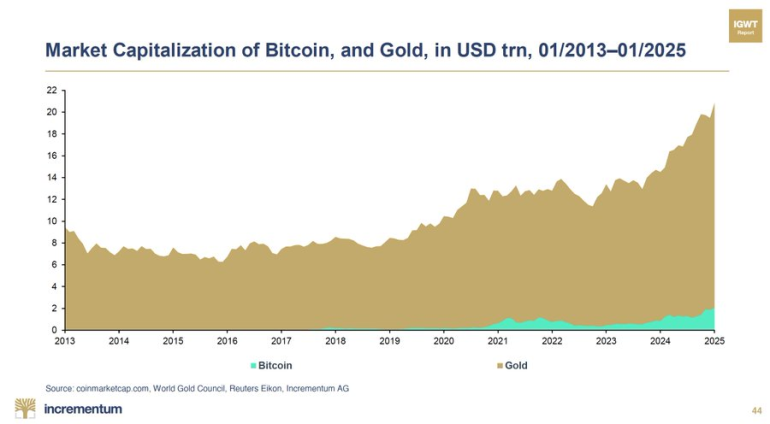

Historically, gold has been the preferred option in times of economic uncertainty, recently reaching an all-time high near $3,000 per ounce. However, a generational shift is underway: while traditional investors continue to favor gold, younger generations are turning to bitcoin.

As Porter Stansberry recently stated in an interview:

The government's debt is your problem until you own bitcoin. The moment you own bitcoin, their debt becomes your greatest asset.

This is because bitcoin, like gold, is a scarce asset resistant to inflation, but with the added advantage of being digital, decentralized, and easily transferable. Its growth compared to gold is evident, and more people see it as the best alternative to safeguard against the U.S. fiscal crisis.

Final Thoughts

The debt problem continues to worsen, and while spending reduction efforts are a step in the right direction, the reality is that the current financial system still promotes greater money issuance. In this context, bitcoin is emerging as a viable option to protect against the growing monetary crisis.

The key question for any investor today is: Do you believe bitcoin will continue gaining ground over gold, or do you think gold will maintain its dominance as a store of value?

Regardless of the answer, one thing is certain: ignoring the impact of debt and inflation on our personal finances is not an option. As long as the deficit keeps growing out of control, the best strategy is to protect oneself with solid, decentralized assets like gold and, increasingly, bitcoin.